child tax credit december 2021 payment

To reconcile advance payments on your 2021 return. The credits scope has been expanded.

Tax Credit Definition How To Claim It

Your newborn child is eligible for the the third stimulus of 1400.

. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. The IRS began issuing child tax credit payments on July 15 2021. Eligible families have received monthly payments of up.

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. Even though child tax credit payments are scheduled to arrive on certain dates you may not. The IRS sent out the last monthly infusion of the expanded child tax credit Wednesday -- unless Congress acts to extend it for another year.

November 19 2021 saw the House Democrats pass the 175 trillion Build Back Better program which would see the enhanced Child Tax Credit payments remain in place for. Get the Child Tax Credit. For parents with children aged 5 and younger the Child Tax Credit for December will be 300 for each child.

The IRS bases your childs eligibility on their age on Dec. The 2021 advance monthly child tax credit payments started automatically in July. Decembers child tax credit is scheduled to hit bank accounts on Dec.

Half of the total is being paid as six monthly payments and half as a 2021 tax credit. Get your advance payments total and number of qualifying. The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and 500 for college students aged up to 24.

How Next Years Credit Could Be Different. You can claim the other half of the entire CTC when you file your 2021 tax return. For parents with children 6-17 the payment for December will be.

Find out if they are eligible to receive the Child Tax Credit. The IRS has made a one-time payment of 500 for dependents age 18 or full-time. For each kid between the ages of 6 and 17 up to 1500 will come as 250 monthly payments six times this year.

Eligible families who did not opt out of the monthly payments are receiving 300. See irs schedule 8812 form 1040. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month.

Previously only children 16 and younger qualified. From July through December 2021 the IRS pre-paid half of the entire credit amount in monthly instalments. While the monthly Child Tax Credit payments have now come to an end in theory at least anyone who did not claim these payments will be able to receive the full amount of.

15 and some will be for 1800. Your newborn should be eligible for the Child Tax credit of 3600. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to.

Understand how the 2021 Child Tax Credit works. Understand that the credit does not. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are.

President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least. The sixth and final advance child tax credit CTC payment of 2021 is being disbursed to more than 36 million families Wednesday the IRS announced. It also provided monthly payments from July of 2021 to December of 2021.

ONE final advance child tax credit payment is coming in 2021 and the 300 payment is scheduled to reach families this week--just in time for the Christmas holidays. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Child Tax Credit 2022.

If you did not receive the stimulus for a.

The Child Tax Credit Toolkit The White House

The Child Tax Credit Toolkit The White House

Child Tax Credit Definition Taxedu Tax Foundation

What Families Need To Know About The Ctc In 2022 Clasp

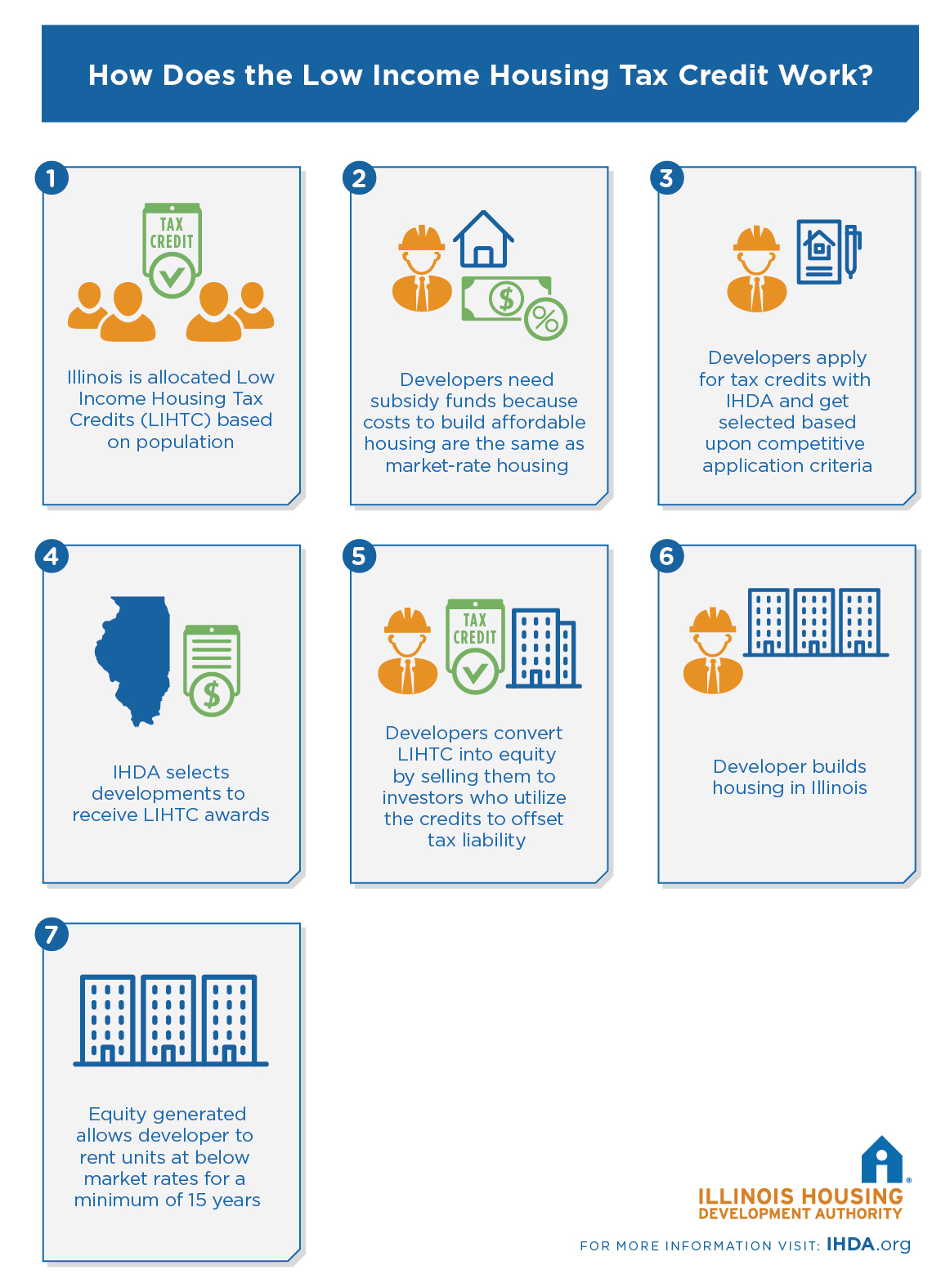

Low Income Housing Tax Credit Ihda

![]()

2021 Advanced Payments Of The Child Tax Credit Tas

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

The Child Tax Credit Toolkit The White House

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

2021 Child Tax Credit Advanced Payment Option Tas

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca